Compare Assets

Discover the benefits of investing in mortgage notes and how they compare to traditional investment options.

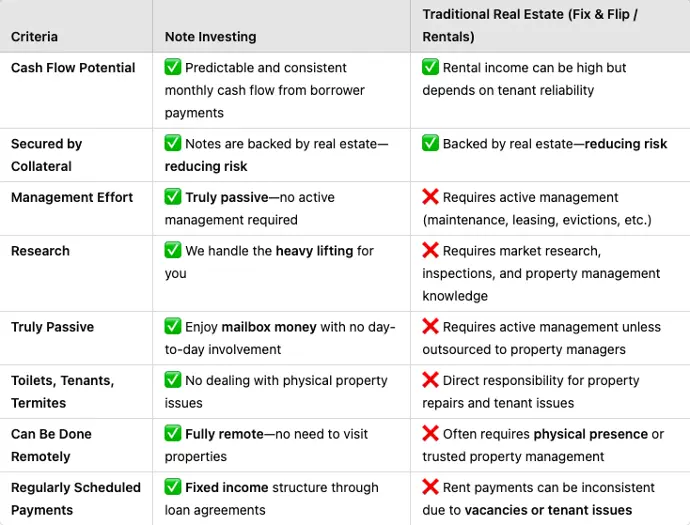

Note Investing vs Traditional Real Estate

At The Sol Group, we offer a superior alternative to traditional real estate investments like fix-and-flips or rentals through strategic note investing. Our approach reduces financial risk while delivering a steady stream of passive income—without the burdens of property management, maintenance, or tenant-related issues.

Beyond providing a hands-off investment experience, note investing with The Sol Group allows for greater portfolio diversification, all while avoiding the overhead costs associated with physical property ownership. With our deep market expertise and effective risk assessment, we ensure a streamlined and profitable investment process, helping you build long-term wealth with confidence and security.

Note Investing vs Stocks & Crypto

The Sol Group offers a more stable and secure investment option through note investing, providing a reliable alternative to the unpredictable nature of cryptocurrency and stock markets. Unlike these markets, our investments are backed by tangible real estate, ensuring collateral security that stocks and crypto simply do not offer.

With note investing, The Sol Group delivers predictable, steady returns and regular interest payments, creating a consistent income stream without the extreme volatility of crypto and stocks. Our approach is data-driven and strategic, minimizing speculation and maximizing long-term financial growth, making it a smarter, more reliable choice for investors seeking stability and passive income.

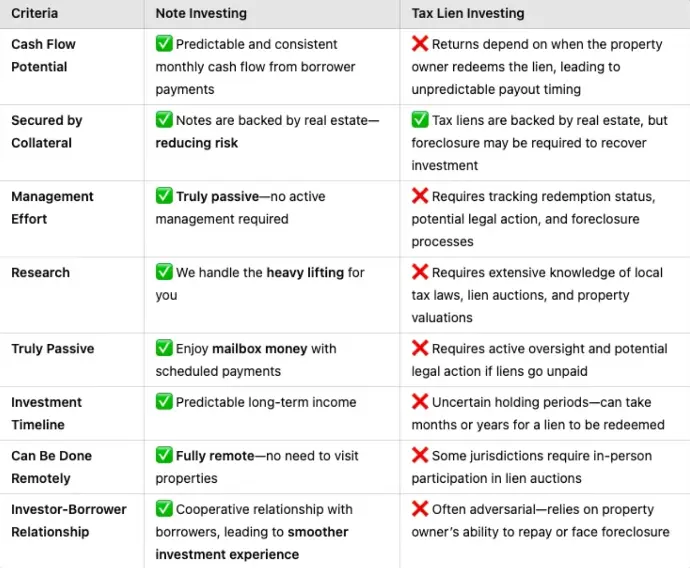

Note Investing vs Tax Lien Investing

At The Sol Group, we offer a superior investment option through note investing, providing predictable cash flow, consistent monthly returns, and greater control over investment outcomes—all with lower operational complexity compared to tax lien investing.

Unlike tax lien investments, which depend on property owner actions and often result in unpredictable payout timelines, note investing ensures steady, scheduled income through structured loan agreements. Additionally, note investing fosters a cooperative relationship with borrowers, avoiding the adversarial nature of tax liens while creating a more stable and secure financial arrangement.

With The Sol Group, investors gain access to broader market opportunities, a diversified portfolio, and a streamlined investment process, ensuring a reliable and mutually beneficial investment experience.

Frequently asked questions

Here are some common questions our company gets asked.

A mortgage note (also called a promissory note) is a legal document that a borrower signs at closing, which serves as a written promise to repay the loan. It outlines the loan amount, interest rate, repayment schedule, and consequences of default.

The mortgage (or deed of trust) is a separate document that secures the loan by giving the lender a claim to the property if the borrower defaults.

In short:

- Mortgage Note = Borrower's promise to repay.

- Mortgage = Lender's security interest in the property.

Passive!

- Choose Your Investment Amount: Investments can range from $60,000 to $150,000.

- Expect Returns: Look forward to an annual return of 7-8% on your investment.

- Receive Monthly Payments: Benefit from regular monthly mortgage payments from the borrower.

- Enjoy Peace of Mind: Relax knowing your investment is secure and managed professionally.

Contact us here